Although waiting an extra day or two for a loan to deposit might not sound like a long time, it can make a big difference for a borrower struggling to make ends meet.

Once a loan is approved, paying out the funds ideally shouldn’t take more than a day. But due to legacy infrastructure and overreliance on manual processes, borrowers are often left waiting for days and sometimes weeks before receiving their deposit. The good news is: this doesn’t have to be the case.

In the third part of our series on the lending workflow, we dive deep into the pay-out process that happens once a loan is approved. We look at the problems lenders currently face, how Open Banking improves the workflow and the specific technologies that enable faster payouts.

The problems lenders face when paying out loans

Not being able to move money to their clients 24/7 and quickly

According to a Digital Banking Report in 2020, the average “time to decision” for most consumer loans is usually between 3 to 5 days, but the “time to cash” can be a week or longer. With banks, the “time to cash” can be as long as 3 months!

In a world where mortgages and current accounts can be applied to and opened instantly, waiting over a week for cash is no longer acceptable. Unfortunately, due to overly manual processes, outdated legacy systems, and required credit checks, lenders are often unable to move their clients’ money as quickly as they would want to.

This was especially highlighted throughout the Covid pandemic, where small businesses and consumers required loan deposits as quickly as possible, and many lenders and banks simply could not meet the demand. Enabling faster payouts not only helps borrowers, but also helps lenders by allowing them to deliver multiple loans at once and experience lower card cancelation rates.

Read more: Decisioning: what it takes for lenders to make accurate credit decisions

Lack of automation

Approving and processing loans is still a very manual process for lenders. In the past, this was for a good reason: many long-standing policies depended on manual reviews and cross-checks. Financial institutions rely on these policies to keep risk as low as possible.

However, modern-day consumers and businesses are getting used to the “self-service” experience: being able to complete an application online, get a result almost immediately and then receive a payout shortly after. The issue is that this is only possible by embracing and implementing automation and getting rid of manual processing.

Read more: Onboarding: how lenders can nail the first step of the lending process

Although lenders may be hesitant to implement automation due to alleged risk, the truth is that automation is also a lot safer for customers: lenders can effectively integrate payouts within the decisioning process, which means they don’t need to exchange or store sensitive information, and consumers can receive their money almost immediately.

Lack of automation also increases the number of human errors, such as duplicate payments and incorrect data input, which increases the overall cost of the payout. This leads us on to the third problem…

High payment processing costs

Payment processing costs are high, and they’re only getting higher.

This is mostly due to many lenders still relying on manual payout processing and regular card transactions. The former means that the human capital is higher and therefore so is the cost — not to mention the expense that comes with making mistakes. According to Genpact, implementing automation within the payout process could decrease costs by 70% for lending institutions.

As regards the actual payment method, the “traditional” regular card transactions utilised by most lenders are simply very pricey and, as we’ll see below, they’re actually a lot more expensive than direct account to account payments.

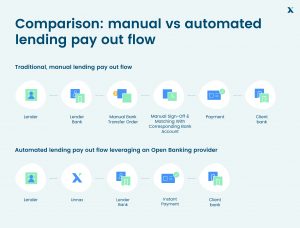

The payout workflow with and without Open Banking

Is Open Banking the solution to help modernize the pay-out process for lenders? Let’s compare the workflow with and without Open Banking.

The traditional way

Usually, payouts are completed by hand. That’s because, as mentioned before, lenders still rely on policies that require manual reviews and cross-checks that are built on years of analyses of defaults and assessments. Once an application is submitted, it is usually manually reviewed by an employee, who relies on checklists and certain criteria to make a decision.

After a loan is approved, the employee needs to head to the lender’s bank account and transfer the loans, one by one. Each transfer needs to be signed off and matched with a corresponding bank account, in order for the transfer to be approved. This is usually where the delay is, highest cost and highest chance for error.

Let’s see what this process looks like via Open Banking.

With Open Banking

With Open Banking, the process happens a lot more smoothly.

Open Banking allows the payout to be done programmatically using payment initiation. This means that the payment is automatically pushed from the lender’s account as soon as the loan is approved. Payments are made via instant transfers, which means that the money arrives at the destination account in minutes.

By using certain intelligence on top of a payments API, such as Unnax’s waterfall system, payments can be integrated into the decisioning process and go through in a few minutes (less than 15 minutes, to be exact). Lenders also don’t have to complete Strong Customer Authentication (SCA) to complete the payment because transfer signatures can be automated by using delegated bank accounts.

Open Banking also enables account to account transfers, which doesn’t require an exchange of details and therefore increases consumer data protection. The entire process happens online, which therefore enables a complete digital record of the transaction and agreement. This is different from the traditional way, which will often include a paper trail and requires disclosing sensitive information.

Read more: How To Improve Payment Processing With Direct Bank Transfers

Most importantly of all, Open Banking decreases the time of payout to minutes. This means that once a loan is approved, the borrower can receive their funds in under 15 minutes. This is largely due to the technologies that Open Banking is based on.

Technologies that enable a faster payout

Payment initiation

One of the most important technologies of the Open Banking movement is payment initiation, which allows a licensed third-party provider to initiate a payment order on behalf of the lender.

With Open Banking, lenders can push a payment directly from their account. Yes, it’s just like a bank transfer, except that it can now be triggered by a licensed third party (no more manual payouts!).

There are many benefits to payment initiation, with the main one being that the payment experience is quick and seamless for the consumer. The other main benefit is that since it bypasses many of the intermediaries, it’s a lot cheaper than card payments.

Best of all, payment initiation is a technology that can be integrated into decisioning, allowing lenders to offer a completely self-service experience to loan applicants.

Read more: Everything you need to know about payment initiation

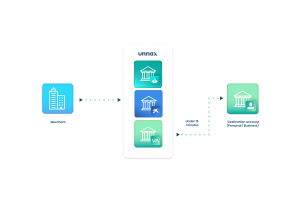

Waterfall system

The waterfall system is one we designed at Unnax which allows us to optimize the consumer finance loan payout.

Payment delays and high fees often occur when the transaction between the merchant and destination account takes place between two different financial institutions (e.g. La Caixa and BBVA).

With the waterfall system, our API can automatically pick a funding account that is the same as the destination account. This is what allows the transfer to go in real-time, without any added fees. By using this cascading logic workflow, we ensure that payments are processed at the lowest cost and highest speed, at all times.

Lenders and borrowers want the same thing: instant, automated payouts. Till now, the main issue holding lenders back has been the reliance on manual processes and legacy IT systems. The good news is that with Open Banking, payment initiation and the waterfall system, lenders can finally deliver a lending workflow that is affordable, self-service, and most importantly, fast.