It feels like almost every week, another part of our world gets parsed into an “as a Service” package. This growing trend shouldn’t surprise anyone. As hardware, software, bandwidth, and protocols continue to evolve, more processes and resources can go from in-house to outsourced.This subsequent advancement drives the digitalization transforming industries across the globe.

Financial services are no exception with Banking as a Service (BaaS) opening up banking functionality to the world. However, like almost all things finance, there is a considerable bit of mystery shrouding BaaS. We want to lift the veil on Banking as a Service to shed light on its upsides, usages, and limitations.

What is Banking as a Service?

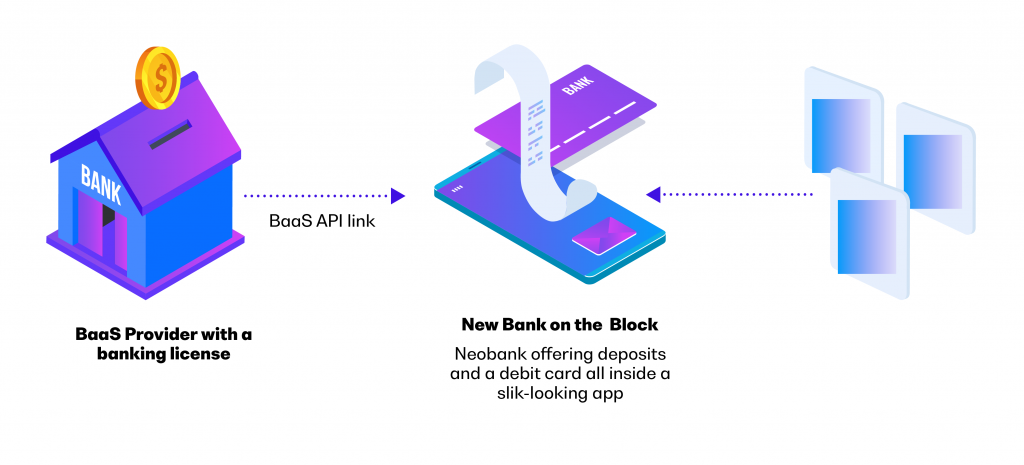

Banking as a Service is the act of taking bank functionality as a whole, compartmentalizing it, then individually offering each function to non-financial companies. Like other “as a Service” models, BaaS uses mainly application programming interfaces (APIs) to provide connectivity with its users. As the providing bank has all of the regulatory permissions to offer banking services, BaaS users can integrate them without having to go through burdensome regulations themselves. Together, these factors enable non-financial companies to build new products using banking services such as deposits, money transfer, payments, currency exchange, lending, and more.

Most common BaaS bank functionalities on the market

Banking as a Service use cases are far-reaching. Here are some of the most common BaaS deployments today.

Card payment and processing

BaaS enables non-financial companies to add branded payment services to their product line-up. These services allow firms to offer white-labeled debit cards, which increase brand loyalty and greater insights into their customers’ behaviors.

Identity verification

In many non-banking industries, companies must verify every potential customer’s identity. Using BaaS, firms across a variety of industries can plug into a bank’s KYC API to quickly and affordably verify their identity.

Lending

Retail sectors such as travel and eCommerce often sell big-ticket items. These firms can provide on-platform financing using a consumer lending BaaS API. The providing bank underwrites and potentially finances the loan, helping the merchant convert big sales.

The plug-and-play neobank

BaaS lets any company pick and choose a variety of banking services. In many cases, a firm incorporating Banking as a Service into their products might only need a particular functionality. Some startups though, see BaaS as the perfect medium to re-invent the entire banking experience by creating neobanks. These firms use Banking as a Service to provide everything from a payments card to segregated customer accounts. Other entrepreneurs focus on a specific banking vertical such as currency exchange deploying BaaS to disrupt notoriously fee-ridden services.

How to Build a Neobank Using Only BaaS APIs

How BaaS provides value to users, firms & banks

Banking as a Service creates a world of benefits for end-users, non-financial companies and even banks.

BaaS benefits for the end-users

First and foremost, Banking as a Service is overwhelmingly positive for the end-user. As more companies add digital financial services, consumers get more choice. More choice means more competition. As a result, fees go down and user experience goes up. Moreover, thanks to the combination of BaaS with machine learning, automated customized experiences bring private banking to the masses.

BaaS benefits for financial companies

Consumers aren’t the only ones who benefit from Banking as a Service. Firms specialized in accounting, corporate finance and SME lending can leverage BaaS to give businesses more choice and better services.

BaaS benefits for non-financial companies

Highly competitive industries like eCommerce and travel have notoriously thin margins. For companies in these arenas to survive, they must both prove their worth and diversify their revenue streams. BaaS satisfies both needs. For example, travel companies can issue prepaid debit cards to their clients to use while out exploring the world.

Understanding customer spending habits is one of the most valuable marketing tools companies can have at their disposal. For firms using Banking as a Service, they become primary sources of customer financial data. More importantly, providing banking services helps keep users on-platform, regardless of the industry. BaaS represents a potent competitive weapon in cut-throat business across the spectrum.

BaaS benefits for banks

Finally, the banks themselves benefit from BaaS. After all, banks already have banking licenses. By offering services through their system to third parties, they can earn valuable fees and deposits. Additionally, becoming a BaaS provider has in-house upsides as well since it means transforming their legacy tech stack into a modern, cloud-based one.

BaaS’ limitations

Despite the many advantages with BaaS, there are also some inherent drawbacks. First, having limited views and knowledge of banking can make it difficult for firms to address customer issues. In this instance, a company looking to incorporate BaaS should make sure their provider has robust support for any client or tech-related matters.

Second, regardless of their reputation, consumers still tend to trust banks with their money. This relationship creates a formidable conversion hurdle for the BaaS user to overcome. Companies wanting to implement BaaS-driven products should anticipate these minor limitations when planning and developing new services.

Traditional Banking vs Banking as a Service

A comparison between traditional banking and BaaS for incorporating financial services into a company’s offering.

Open Banking and BaaS: data vs. functionality

In the fast-moving world of Fintech, many words and phrases get tossed around, often a bit too liberally. This farrago leads to understandable confusion, especially among similar-sounding terms. Open Banking and Banking-as-a-Service tend to get used interchangeably. However, that’s incorrect.

Open Banking is about the opening of banking data from banks to third parties. Under this system, external companies known as third-party providers connect user bank data to non-banking entities. In turn, these entities use that information to help improve their services. For instance, an eCommerce company can use a customer’s banking data to determine if he is a trustworthy candidate for a loan. BaaS, on the other hand, is about providing banking functionality to non-banks. Instead of looking at user data, the non-bank entity can incorporate certain banking functionalities into their services. In other words, a company using a BaaS service is creating financial data through functionality, not merely accessing it.

BaaS vs Open Banking: Why They Are Not The Same

BaaS and Open Banking both operate on Fintech APIs. Otherwise, they serve distinctly different purposes

BaaS in action

The innovative possibilities of Banking as a Service are far-reaching. Let’s say that a startup believes it can build a better banking experience than what’s on the market, yet it doesn’t have the resources to apply for a banking license. Instead, the founders turn to a BaaS tech provider to build their ‘bank’ on top of the provider’s stack.

To hold deposits, the startup opens e-money accounts at the provider. The provider has the banking license as well as the deposit insurance, which effectively transfers the risk and many compliance requirements away from the startup, allowing the team to focus on building a great product and marketing it. The startup also wants to initiate payments from their app. The developer checks the provider’s sandbox to consult an example. He sees how easy it is to implement, and with a couple of lines of code, the app now has a payments function.

Finally, the CEO has a grand vision of providing financial management tools to customers. The head of product quickly checks with their provider and learns about their savings and aggregation tool. In addition to reading the accounts, the BaaS provider gives each user a segregated sweep account to place unused funds towards a user’s defined goal. With Banking as a Service, the startup can get to market with less capital and administrative time than by using the bank itself.As technological and regulatory advances continue to disrupt banking, BaaS-driven innovation will only continue to accelerate. Understanding how Banking-as-a-Service works, and how non-financial companies can use it in their product suite is critical to maintaining an edge in many highly competitive industries. From there, the creative possibilities are limitless.